The ultimate guide to home insurance in Canada

How do you protect yourself and your family from the unexpected? If your home is damaged by fire, flood, vandalism, or other perils, you might not have to pay for repairs out of pocket if you have home insurance.

Informed by expert Westland Insurance advisors across the country, this comprehensive guide will help you navigate your home insurance decisions. You’ll learn the basics of home insurance in Canada, including how to compare different policies and how to work with a broker like Westland Insurance to find the best coverage for your needs.

Key Takeaways

- Home insurance is not a legal requirement in Canada, but it is required to get a mortgage. Many landlords also require their tenants get insurance as part of the rental agreement.

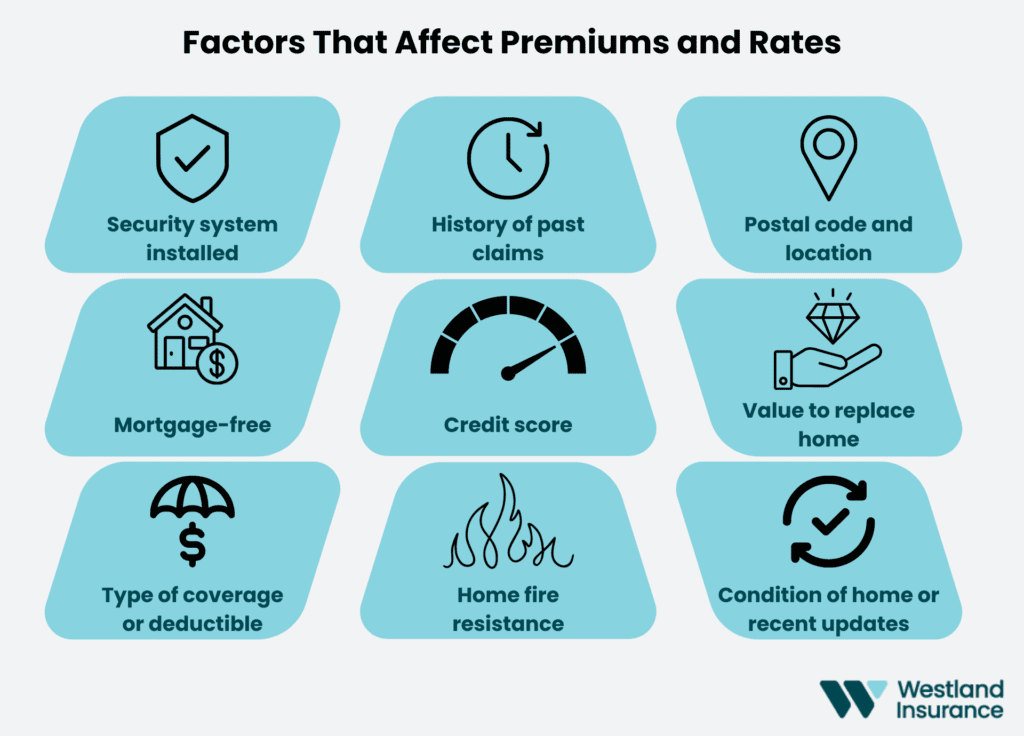

- The price you pay for insurance is based on the condition and age of your home, where you live, your history of claims, and other factors.

- Most home insurance claims can be settled within a few days, although more complicated claims will likely take longer.

- An insurance broker can help you understand your coverage options and ensure you have the best value by comparing different policies and possibly finding discounts for you.

What is home insurance?

Home insurance helps you pay for the damage to your home and belongings due to unexpected events. It can cover your living expenses if you must stay somewhere else while your home is fixed. Home insurance gives you peace of mind that you can afford to repair your home from things like natural disasters, vandalism, or water damage.

Home insurance also covers the cost of rebuilding your home if it’s beyond repair and protects your personal belongings. Keep in mind, some items such as jewelry, expensive collectibles, and other high-value possessions may require additional insurance to insure each item specifically.

How does home insurance work?

Getting home insurance may seem daunting at first, but when you break down the process, it’s quite simple!

Step 1: Choose a broker

The first step is to find an insurance broker you trust, such as Westland Insurance. A broker will let you know what information is required to prepare a quote. They’ll compare quotes from different insurers and recommend the options that best match your needs. At Westland, our advisors go the extra mile every step of the way and do the legwork to provide personalized coverage solutions that fit your life.

Step 2: Pick your policy

A good broker will get to know you, take the time to properly understand your circumstances, then recommend the best insurance provider and coverage package available to you. At Westland, we keep things simple and use language that everyone can understand. A word you’ll hear often is premium ― this is the price you pay annually or monthly for insurance coverage. You can pay for the full year in advance or set up a monthly payment plan.

Premiums are based on base rates, plus additional fees or discounts determined by the “risk” of your home sustaining damages. Risk is determined by many factors, including the age and maintenance status of your home, its geographical location, and your claims history.

Skip ahead to read more about how premiums are determined.

Step 3: Finalize your policy

When you’ve chosen your coverage package, you’ll receive important documents including:

- Proof of insurance

- Instructions for handling emergencies and claims coverage amounts, limits, exclusions, and deductibles.

Step 4: If the unexpected happens (and we hope it doesn’t!), make a claim

If your home or property sustains damage or is lost and you wish to make a claim, contact your broker as soon as possible. They’ll help review your insurance policy, policy wordings, or the claim allowances of your plan. If you’re unsure if your insurance covers your damage, just ask! As an added value to clients, Westland has a dedicated claims department. Our claims experts advocate for our clients to reduce stress during a challenging time.

Skip ahead to read more about claims.

Understanding additional living expense coverage

If you can’t live in your home during repairs or a complete rebuild, you may qualify for reimbursement for some living expenses. This type of coverage can also apply when there is a mass evacuation order and you’re forced to evacuate your home, such as in the event of a wildfire or flood. This is called Additional Living Expense Coverage. It will cover reasonable additional expenses until your home is habitable or you reach the policy limit.

Most reasonable expenses will be covered, so long as it’s like-for-like with your prior living circumstances. This coverage can be used for expenses like:

- Accommodation

- Food, if your temporary accommodation has no means of cooking

- Transportation costs or increased mileage due to temporary location

- Storage costs

- Pet boarding or care

You can’t use this part of your insurance for:

- Mortgage payments

- Lost wages

- Utility bills

- Other usual expenses such as cell phones, memberships, or transportation

Is home insurance mandatory in Canada?

Home insurance is optional, but you may need it to get a mortgage on your home. If you still owe money on your home (i.e., mortgage) your lender will ask you to have home insurance to safeguard their investment. You may be asked to show proof of insurance which your broker can give you when you purchase your policy.

Some landlords also require their tenants to have a renter’s policy before they move in. This gives the tenant and landlord peace of mind that the renter’s personal contents and belongings will be covered in the case of a loss and that if they need to vacate the rental unit temporarily, they will have additional living expense coverage.

Benefits of home insurance

While home insurance may not be a legal requirement in Canada, it can provide much-needed peace of mind to protect your home and your family.

Why every Canadian homeowner and renter needs home insurance

Home insurance gives you peace of mind, knowing you have financial support should the unexpected happen. Your insurance may:

- Pay for home repairs due to damage from vandalism, fire, flood, weather, or other included natural disasters. Check your plan for included coverage.

- Cover the cost to rebuild your home if it’s damaged or destroyed by a peril and is no longer habitable. Temporary living costs during the rebuild may also be covered.

- Cover claims due to third-party injuries on your property, such as a slip and fall.

- Protect your personal belongings and provide limited compensation to restore them to their original condition.

Having the right home insurance coverage has helped Westland clients

Very professional and friendly service by Danielle. She helped me get the best insurance for my home at a very reasonable price and went out of the way to find me multiple quotes for my property. I would highly recommend using Westland insurance and look for Danielle for the best options and advice.

In a week I’ll be moving into the third house we’ve bought in the past five years. After three policy changes and one major claim at that time I can say that my experience with my broker, Gary, has been nothing short of spectacular. Every time I contact him, I’m met with sincerity, professionalism and a thoughtful human being. He’s always made the process of home insurance painless and convenient. Words in a review probably doesn’t do his customer service justice, but I hope someone looking for a broker might look at this and give Gary a call.

Colin sprang into action and within 72 hours, no shortage of emails, it was all wrapped up. Colin used clear and helpful language in his explanations of our options. Everything you want in an insurance expert, he had, again, not only in being prompt, but most importantly, he explained everything in just the right amount of detail. I would strongly recommend using Westland Insurance next time you need an insurance broker.

Types of home insurance policies

There are many types of home insurance policies in Canada:

- Homeowners insurance: This type of insurance covers the property and belongings of the family living in the home and liability if you cause injury or property damage to others.

- Condo/strata insurance: This type of insurance covers the personal property and liability of unit owners in a condo or strata. It’s required in addition to the building’s corporation insurance which would cover the cost of damage or loss to the building, common property, or assets shared between unit owners.

- Tenant/renter insurance: As a renter, you could be liable for any damages or bodily harm caused to or in your suite. This type of insurance protects your personal belongings and liability when you rent a home or apartment. It covers the cost of replacing or repairing your possessions if they’re damaged or stolen by an unexpected or accidental event, such as a fire, flood, or break-in. It also covers the cost of legal fees or medical bills if you’re sued or held responsible for injuring someone else or damaging their property. Tenant or renter insurance doesn’t cover the building or the landlord’s property, which is usually covered by the landlord’s insurance.

- Seasonal and secondary residences: You can insure secondary suites or a seasonal home, like your summer cabin or cottage, with your primary residence home insurance, or insured as a separate property. Seasonal home insurance protects your vacation homes and secondary properties, along with the contents of those properties that you visit or live in part-time. Seasonal home insurance is separate from your primary home insurance and may have different coverage options and limits depending on your property and usage. You should contact an insurance agent to find the best policy for your seasonal home. At Westland, our brokers can help you insure a seasonal residence with your primary residence to save money and simplify your insurance. You may qualify for savings and discounts by bundling your policies and having one point of contact for your insurance claims.

- Heritage home insurance: If your home is a designated heritage home, it may qualify for a special type of home insurance to cover the unique risks and circumstances of these types of homes.

- Landlord and Short-term rentals insurance: If you rent out part of or all of your home either to long-term or short-term tenants, you must ensure that your insurance has you covered. Homeowners insurance usually does not cover business activities, such as renting out your property on a short-term basis on hosting sites like Airbnb or VRBO, so you may need a specific coverage that is tailored to your rental needs and situation. Landlord and short-term rentals insurance can help you pay for repairs, replacements, legal fees, medical bills, and lost rental income in case of a claim. It can also give you pea

What does home insurance typically cover?

Depending on what home insurance you purchase, it may include the following:

- Insured parties: Insured parties are the people who are protected by the home insurance policy. This often includes the policyholder, their spouse or partner, and their relatives or dependents who live in the same household. Insured parties can claim compensation for damage or loss to their property or liability for harm to others.

- Insured property: This is the physical property that is covered by the home insurance policy. It usually includes the dwelling, the detached structures, the additional living expenses, and the personal property.

- Personal property. Your policy will cover your personal possessions. You may need to document some items like collectables and jewelry so you can prove possession and value. This information will be stored on file in case you need to make a claim.

- Insured risks:

- Covered perils. These are the “perils” or events that can result in damage or loss to the insured property or liability for the insured parties. They usually include fire, theft, vandalism, water damage, windstorm, hail, lightning, explosion, earthquakes, falling objects, and civil unrest. Your policy documents will outline which events are covered and which are not or if there are any limits.

In addition to the named inclusions above, you can typically choose from four types of policies depending on what you need and what you can afford:

- Comprehensive: This is the most inclusive home insurance policy. Your home is covered for all risks, except specific exclusions.

- Broad: This is a mix of comprehensive and standard, where your home is covered for all risks, except exclusions, and your property is only covered by named risks.

- Standard or named perils: One step down, standard policies include named risks to your home and contents.

- Fire and Extended Coverage: This is the basic or minimal amount of coverage you can get. It’s usually only offered when the home doesn’t meet the usual standards for insurance.

No matter which policy you get, always read the inclusions and exclusions carefully before purchasing, as even comprehensive plans have exclusions or limits.

Additional coverages: For extra peace of mind

As we mentioned, even comprehensive coverage has exclusions. In many cases, you can purchase additional insurance to cover these exclusions. For example, if you live in an area susceptible to flooding or earthquakes, you can buy optional add-ons to increase your limits and coverage or lower the deductible you would pay in the event of a loss.

Another coverage we also recommend adding to your policy is sewer backup. Water damage caused from sewer back up can cause extensive damage to your property and belongings. This isn’t usually automatically covered in home insurance policies so adding the additional coverage can give you extra peace of mind if your sewage lines back up into your home and cause damage.

What home insurance often doesn’t cover

Owning a home comes with certain expectations and risks that your home insurance won’t cover, even with added coverage or riders.

Typically, the following will not be covered:

- Wear and tear: Damage due to gradual deterioration, aging, or failure to maintain your home and property such as leaks, rust, and corrosion aren’t covered. Westland brokers can provide you with tips on how to prevent this type of damage.

- Appliance repairs or replacements, unless caused by vandalism, theft, or other included perils

- Some natural disasters, such as flooding

- Damage or loss that results from involvement in illegal or fraudulent activities

Mandatory homeowners insurance requirements

As we mentioned, there are no legal requirements to have home insurance in Canada, except if requested by the lender for your mortgage to help protect the bank’s investment in your home.

If you don’t get a home insurance policy before the closing date of your home, your mortgage may be denied. You’ll often have to show proof of insurance as part of your closing paperwork on your home and mortgage.

How much does home insurance cost?

After types of insurance, one of the most common questions insurance brokers are asked is, “How much is home insurance going to cost?”

Here’s a breakdown of home insurance costs, how they’re determined, and where you can find savings.

What are premiums and deductibles?

Two common words you’ll hear in home insurance are premiums and deductibles.

Premiums are the price you pay for insurance coverage. You can pay for the full year upfront, set up a monthly payment plan on your credit card, or directly deduct from your bank account. Keep in mind that payment plans typically include interest and / or processing fees.

👉Jump to learn more about how premiums are calculated.

Deductibles are how much you need to pay out-of-pocket for a claim before your policy will cover the remaining amount. Higher deductibles will help decrease your policy premium. Just be mindful that you must pay the higher deductible for a claim.

How are home insurance rates determined?

Your premiums are determined on a case-by-case basis. They usually start with a base amount, and then additional adjustments are made based on factors such as:

- Your home’s assessed value.

- The type of your home, such as single family, condo, townhome, etc.

- The age of your home and how it was constructed

- Your geographic location

- Crime history in your neighbourhood

- Discounts you may qualify for including those related to your age, or personal credit score

- Safety measures, such as if you have a home alarm system, have fire sprinklers, how close it is to a fire hydrant and fire hall, etc.

- Value of the belongings in your home

Westland Insurance advisors are experts in home insurance. We have a large network of insurers that we can tap into – guaranteeing great rates and options – so clients know they’re not missing out.

How to lower insurance premiums

Your home insurance premium is customized for you and your home, meaning there are opportunities to lower your rates. You may qualify for lowered premiums if you:

- Bundle your home insurance with other insurance from the same insurer

- Make your home safer, such as installing a monitored alarm system

- Increase your deductible

- Keep your insurance with the same provider for years to qualify for loyalty discounts

- Have a history of low to no claims

How much home insurance do I need?

Another common question we’re asked is, “How do I know how much coverage I need?” Your broker will help you determine this based on many factors. For example, you’ll need enough coverage to rebuild your home from the ground up in the case of total loss. Westland brokers use building evaluators to understand the cost to replace your home:

Evaluators are only as good as the info they’re given. We work with clients to ensure the finer details are covered, such as luxury kitchen, etc. This allows us to accurately calculate the replacement cost of your home.

When it comes to contents, claim payouts are calculated depending on the “basis of settlement” for the type of policy. It may pay out based on “replacement value,” which means the insurer will pay you the actual cost to replace your items today. For example, for a computer bought five years ago for $3,000, the insurer will pay the value to replace it with a new similar one today. Alternatively, a policy may be based on “actual cash value,” which means the insurer pays for the depreciated amount of insured items. For example, that same computer may only be worth $1,000 today with the depreciation, and that’s all the insurer will pay out.

We recommend that you make a list of your valuable items and estimate how much it would cost to replace them. If you have any valuable collectables, jewelry, or family heirlooms, you’ll want to have these appraised and named in your policy. Your broker can advise if they’ll be covered under your general contents amount, or if you need to add on coverage to cover these items.

Check the category limits, as some policies may place maximum reimbursement costs for certain items like bicycles, jewelry, and art. If the value of these items exceeds your policy maximum, you should consider adding coverage for these items.

For liability coverage, to cover claims for property damage or injury to a third party, you should have at least $2 million in liability coverage through your home insurance.

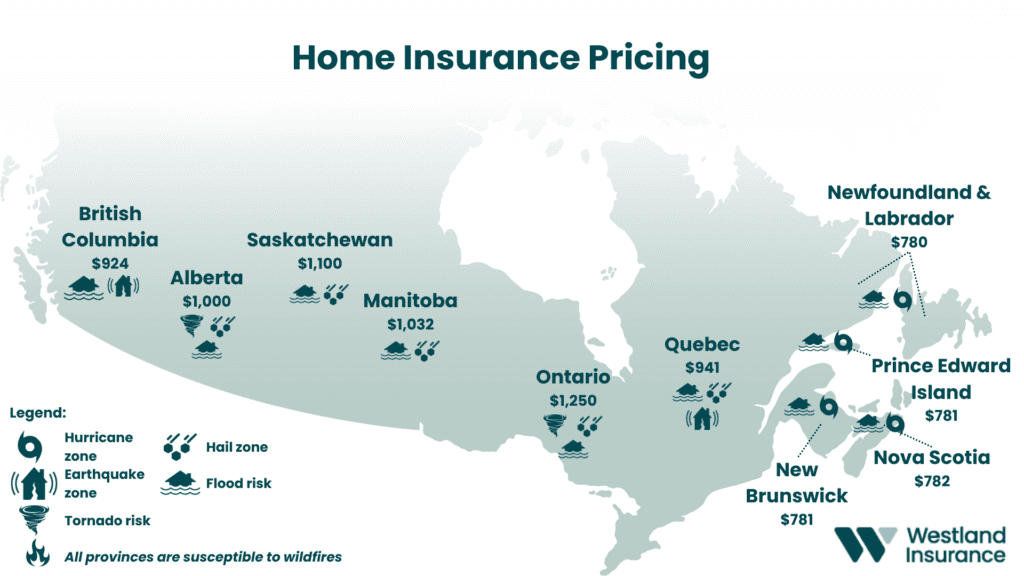

Average costs per province

Depending on where you live, home insurance quotes will differ. Home insurance is based on the physical characteristics and history of the home, and its geographic location. If the same home was built in Vancouver and Fredericton, their insurance rates would likely be different.

This chart estimates annual home insurance rates per province with notes about factors influencing higher rates.

- Alberta $1,000

- British Columbia $924

- Manitoba $1,032

- New Brunswick $781

- Newfoundland and Labrador $780

- Nova Scotia $782

- Ontario $1,250

- Prince Edward Island $781

- Quebec $941

- Saskatchewan $1,100

Remember, these costs are just an estimation. Many factors determine how much you pay for your home insurance. Here are some examples:

- If your home is near a body of water, such as a river, lake, or ocean, it may be more vulnerable to flooding from heavy rain, storm surges, or melting snow. If your home is in a low-lying area, it may also be more prone to flooding from groundwater or runoff.

- Living in an area with extreme weather such as hurricanes, thunderstorms, or blizzards means you may want to get additional coverage for weather-related damage.

- Living in a heavy urban density area, like downtown Toronto, could result in higher rates than living in the Ontario countryside.

- If you live in an earthquake zone like the west coast of BC, your insurance rates may be higher due to the higher likelihood of earthquake damage, compared to the BC interior, which receives few or no quakes.

- Living in an area with historically high crime could result in higher rates.

- If your neighborhood has inadequate flood protection, such as dams, levees, or pumps, it may also be more susceptible to flooding from water or sewer backup.

Shopping for home insurance

Your insurance broker will aim to source quotes from multiple insurance providers and give you recommendations so you can pick the one that best fits your needs. Westland brokers have local knowledge and access to a large network of insurers, so you get the best rates and most suitable coverage.

What you can expect from your broker

A good broker will typically undertake the following:

- Understand your circumstances: Your broker will take the time to learn about your situation and home, then search for suitable insurance policies.

- Highlight key components: Certain aspects of each quote will be highlighted, including your premium, deductible, coverage limits, and exclusions.

- Recommend a policy: It’s difficult to compare home insurance policies that have different specifics. A broker will help you compare quotes to help you find the best coverage at a competitive price.

- Questions and concerns: Brokers are experts in insurance and can answer all of your questions. A broker wants to leave you feeling confident, satisfied, and empowered, with peace of mind that you have the right coverage at the right price.

Westland has extensive experience working with a broad range of insurance providers and seeking quotes from them on your behalf. We’re committed to tailoring plans to your needs and being transparent from start to finish.

Who has the best home insurance?

Online reviews and word-of-mouth can be very helpful in finding a great broker. Westland Insurance has a 4.7-star rating based on 30,000+ reviews nationally. With offices throughout Canada, our local knowledge combined with our national presence gives us the expertise and negotiation power to get our clients the best rates and options with the most reputable lenders in the industry.

How to switch and update home insurance

Your home insurance term is usually 12 months, and at that time, your broker can help you review your home insurance options and seek new quotes. If your needs or circumstances change in the middle of your policy term, your broker can help you update your policy to reflect your current coverage needs.

If you’re considering switching your home insurance, here’s what to do:

- Step 1: Speak with your broker. Your broker has your best interests in mind. They’ll undertake a review of your home insurance to ensure you still have the right coverage, at the right price.

- Step 2: Understand any early termination penalties. If you’re approaching the end of your current policy, you can let it lapse to switch to a new provider without any penalty. You may be charged an early termination fee if you wish to end or switch your policy midterm.

- Step 3: Get quotes. Your broker will get several quotes to compare with your current coverage and will perform all the due diligence on these quotes as they did for your original policy.

- Step 4: Get your new policy first, then cancel the old one. To ensure you have no lapse in coverage, your broker will always ensure you get your new policy and it’s activated before you cancel your old one. This will certify you’re not uninsured for any length of time. Otherwise, if an incident happens during this time, you won’t be covered. When canceling your old policy, make sure to do so in writing. It’s important to clearly mention that you wish to cancel your policy and provide the requested coverage end date.

- Step 5: Inform your mortgage lender. If you make any changes to your home insurance, you may be required to notify your mortgage lender with the details. They require this information on file.

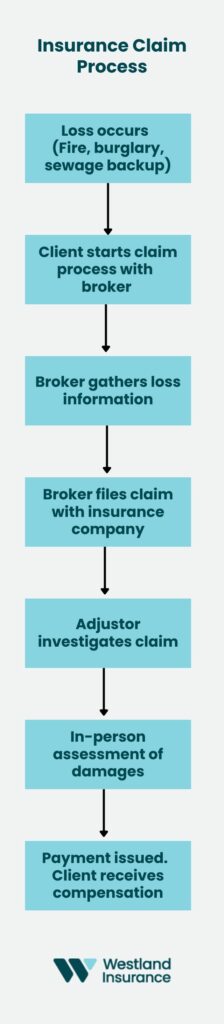

You’ve purchased your home insurance to give you peace of mind. If the unexpected happens and you need to make a claim, here’s what to do next:

How to file a home insurance claim

Contacting your broker is a good first step when you need to file a claim. Westland Insurance has a dedicated claims department to advocate for our clients and take the stress off them during a tough time.

- Start the claims process. Contact your broker as soon as possible. Typically, claims must be submitted within a specific period after the incident. Your broker will ensure you meet this deadline.

- Document everything. It’s very important to document all damage. Be sure to take photos of the damage and keep track of all receipts, communication with repair companies, etc. We always recommend that if in doubt, add it to your records.

- You may get a visit from your adjuster. A field-adjuster may visit your home to verify your claim and your photos. The adjuster will assess the cost of the damage, approve or deny your claim, and recommend the extent of repairs or the dollar amount for compensation.

- Receive your settlement. You’ll then be advised of your settlement terms and amount. Depending on the terms of your insurance policy, you may receive replacement cost or actual cash value. Read more about those terms above.

- Submit a dispute (optional). If you disagree with the settlement amount, you should speak with your broker. Westland’s claim advocates can work with your insurance company to seek a better resolution. If you’re still unhappy, you can contact the General Insurance OmbudService (GIO) , who will provide additional mediation and support to settle the claim amicably for both parties.

Types of claims

At Westland Insurance, we’ve helped our clients navigate a wide variety of claims. The most common claims we see are from fire damage, theft, wind and water damage, and natural disasters. In Canada’s cold climate, we also see many claims from frozen pipes bursting in the winter.

Having the right coverage makes a big difference. Clients with the most comprehensive coverage often have an easier time during the claims process and experience fewer disputes. Here’s what some of our clients have said about their claims experience.

Our experience with David was very positive. He went further into helping with the claim, ensuring Peace Hills was notified, and the adjuster came in a timely manner. We will continue to approach him on future claims, questions and advice.

I can’t speak highly enough of Westland Insurance. My agent Natalie and the whole team are exceptional. Westland Insurance as a company is a powerhouse of efficiency and professionalism. Claims processing has been a breeze, and their team is incredibly responsive and proactive. It’s clear that they prioritize their clients’ well-being and strive to make the insurance experience as smooth as possible. I have complete peace of mind knowing that I’m well protected and supported.

I’ve had a complex claim that involved three insurance companies. Jelyne helped me file claims with two of them, including providing the necessary documentation, which she counseled me on/with, then filed on my behalf. She was thorough, knowledgeable, helpful I’m both thankful and relieved.

How long does a home insurance claim take?

Claims will generally begin processing within a few days. The time it takes for a claim to settle depends on its complexity. The best thing you can do is document as much as possible and stay in constant contact with your broker. They’ll represent you and keep you informed throughout the process.

👉 Learn more about making a home insurance claim.

Addressing common questions: Home insurance FAQs

Home insurance is a blanket term that covers condo, tenant, house, and mobile homes. Homeowners insurance refers specifically to insurance for those that own their homes.

Many will notice their insurance premiums go up every year. This is due both to inflation and the fact that as your home ages, the probability of an issue occurring increases.

Your broker will help find the best insurance solution for you. You can choose a comprehensive package to get the most optional coverages included and add additional coverage for special items if needed.

No. Liability insurance is part of your condo insurance and can’t be bought independently.

As one of Canada’s largest brokers, we have a large network of insurance providers that we can tap into ― guaranteeing great rates, dedicated claims service, and personalized options.

“Being a brokerage that has access to many different markets, we can play with different options like increasing your deductible,” Kristina Booi from Westland says. “Some clients can’t take on the additional risks, so we work with you and your risk tolerance to find what works and what doesn’t.”

Why Westland Insurance?

Westland Insurance started as a small family-owned insurance brokerage in Ladner, BC. Today, we’re the largest independent, Canadian-owned brokerage in the country, with nearly 3,000 employees and 300 locations across the country.

At Westland, we always go above and beyond to connect clients with the coverage that works best for them. From personal insurance to business insurance, our expert advisors do all the work to provide recommendations that fit our clients’ lives. We have a large network of insurers that we can tap into, guaranteeing great rates and options. And we always use straightforward language that everyone can understand. No insurance jargon here!

At every step of the process, we go the extra mile to ensure clients receive the peace of mind they’re looking for. We work hard to provide Canadians with coverage that goes further.

👉 Learn more about why you should choose Westland Insurance.

Conclusion: Equip yourself with the best coverage with Westland

The first step to finding the best home insurance policy is partnering with a reliable and knowledgeable broker like Westland Insurance. We know that navigating home insurance can be an emotional process, especially when you need to make a claim. That’s why we’re not here to sell you insurance — we’re here to help you make informed decisions as your trusted partner.

Your peace of mind is our top priority. Request a quote today.

This article was written with the support of SGI CANADA , one of Canada’s largest insurers, providing great rates and options to Canadians for over 40 years.